Preparing for SEPA: A compliance roadmap for Serbian and regional banks

Serbia officially joined SEPA in May 2025, becoming the 41st country to do so. This is a big milestone for sure, but also just the beginning.

For banks, this isn’t just a symbolic win. It’s a compliance sprint, a technical overhaul, and a major opportunity to modernise services, lower payment costs, and align with the European fintech ecosystem.

So, let’s see what’s next and what banks need to do about it.

What is SEPA, and why does it matter in 2025?

SEPA (Single Euro Payments Area) is a European Union initiative that simplifies and standardises euro payments across member and non-member countries.

It enables faster, cheaper, and more transparent cross-border transactions, aligning non-EU countries with EU-level payment infrastructure and regulation.

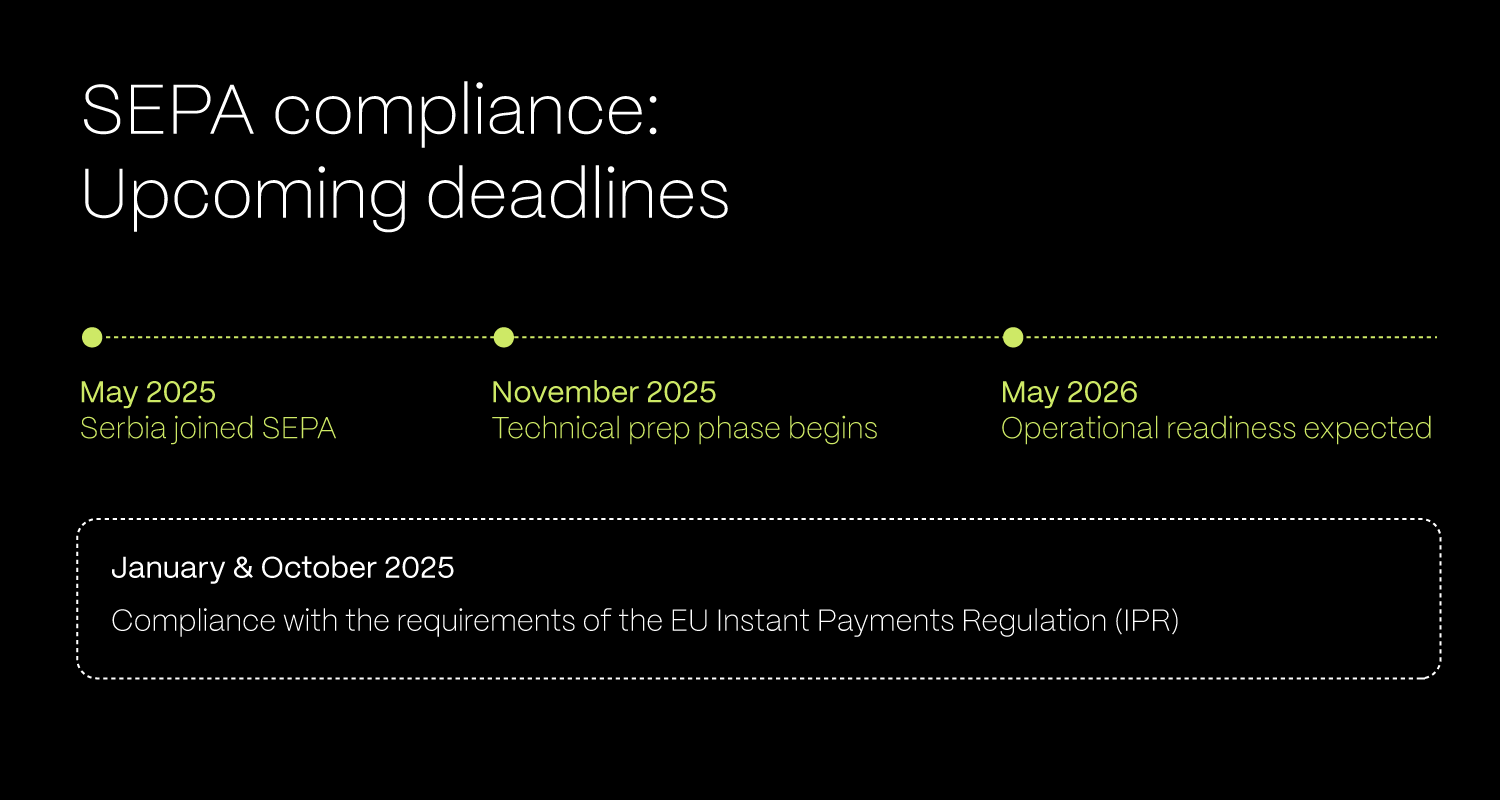

The timeline: What’s coming and when

Serbia officially became a SEPA member on May 22, 2025, marking a pivotal moment in its path toward EU financial alignment. But the real work begins now.

Starting in November 2025, the country will enter the technical preparation phase, during which payment service providers (PSPs) must begin adapting their systems and infrastructure to comply with SEPA’s operational standards.

The earliest expected go-live date for Serbian PSPs to fully participate in SEPA, including credit transfers, instant payments, and direct debits, is set for May 2026.

In parallel, all banks operating in Serbia must also meet the requirements of the new EU Instant Payments Regulation (IPR). According to the regulation, as early as January 2025, they needed to be technically ready to receive instant euro payments, and by October 2025, they must be able to send them as well.

But this transition isn’t just about gaining access to a new payment system. It comes with strict technical obligations. From real-time anti–money laundering (AML) screening to ultra-precise timestamping that ensures payment processing within 10 seconds or less, Serbian banks are facing a fast-approaching and ambitious upgrade cycle.

The next moves for banks in the region

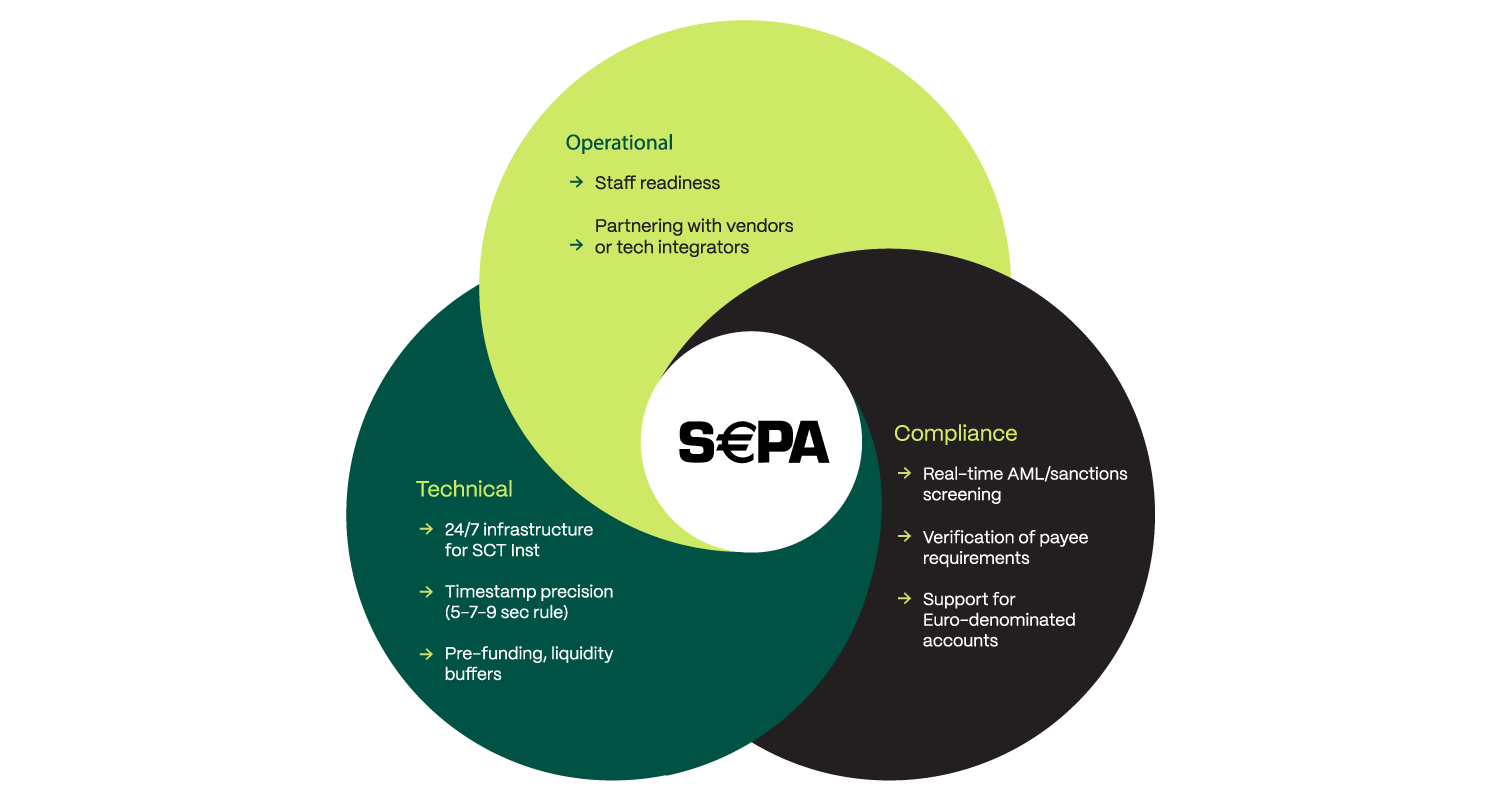

Compliance with SEPA isn’t plug-and-play. For Serbian banks, it requires a substantial overhaul of both technical systems and internal operations.

Building an always-on infrastructure

Banks will need to build 24/7 infrastructure to support instant payments because real-time transfers don’t take weekends off, and neither can your systems. Every transaction must meet precise processing time benchmarks, with timestamps hitting the 5-, 7-, and 9-second marks to stay within SEPA's performance thresholds.

To support this speed, banks must ensure liquidity buffers are in place, as instant payments demand pre-funded accounts waiting for end-of-day clearing is no longer an option. Additionally, API-readiness is crucial to enable seamless real-time communication and integration with EU-wide payment and verification systems.

Meeting SEPA’s compliance standards

On the compliance front, batch processing will become a thing of the past. SEPA demands real-time AML and sanctions screening, making it essential for banks to have the capability to identify risks instantly, before a payment is executed.

The verification-of-payee requirement means systems must be able to match recipient names to IBANs in real time. This is a significant shift in how transfers are validated. And as part of a unified European payment network, banks must adhere to strict security standards, ensuring that all operations meet EU-level expectations for safety and accountability.

Ensuring operational readiness

From an operational standpoint, this transition requires more than just tech upgrades. Banks will need to train teams specifically for SEPA compliance, equipping staff with the knowledge to navigate new systems, processes, and risks.

In many cases, they’ll also need to collaborate with fintech partners or technology vendors to deliver key components of their infrastructure and compliance workflows. Finally, banks should prepare for the unexpected by developing contingency plans, covering everything from downtime and fraud response to handling regulatory audits.

Why this is a huge opportunity

Yes, SEPA brings a host of regulatory requirements. But beyond compliance, it opens the door to a much larger opportunity: competitive differentiation.

Business clients will soon expect seamless, real-time euro payments as the standard, not a premium feature. On the consumer side, expectations are shifting just as quickly.

People want lower fees, instant transfers, and a user experience that matches what they get from leading fintech apps.

Banks that aim for the bare minimum will struggle to keep pace. Those that go further, by offering better UX, real-time notifications, smart API integrations, and even embedded financial services, will stand out in a rapidly modernising financial landscape.

In short, SEPA isn’t just a compliance checkbox. It’s a platform to build on, offering banks a unique chance to future-proof their services and lead the way in regional innovation.

How we can help

Payment systems evolve, so should the tech stack behind them. Our teams help banks:

- build and scale real-time infrastructure;

- automate compliance workflows;

- develop custom integrations with EU payment rails and AML tools;

- monitor performance with dashboards and reporting that satisfy both internal and regulatory needs,

Final thoughts: The countdown is on

Serbia’s SEPA membership isn’t a historic headline. It represents a roadmap with real deadlines. Banks in Serbia have less than a year to meet incoming regulatory and technical requirements. But for those that invest early, the payoff is clear: faster services, cross-border trust, and an edge in a fast-modernising financial ecosystem.

The question isn’t whether you need to prepare. It’s how fast you’re willing to move.